Investor Relations Officers (IROs) are of great importance for listed companies due to their considerable communication function. They provide companies with access to the financial markets, their players and capital. It is undisputed that IROs have extremely expanded their raison d’être over the past decades and play a significant role in the growth and success of listed companies. It is not for nothing that mega-cap companies invest around one million US dollars a year in the function of their IROs (cf. BNY Mellon, 2011). In return, corresponding returns on their work are expected.

This raises the question of the extent to which investor relations contributes to the achievement of corporate goals. How can the performance of IROs be evaluated internally and made measurable?

Systematic IR targeting as a basis for IR measurement

The IR objectives, derived from the corporate objectives, form the basis for measuring IR work: „if you don’t know the aim of your investor relations program, you won’t know whether you’re meeting the program goals“ (Metzker, 2010, p. 10). The first step in measuring IR work is therefore the definition of IR goals. It should be mentioned here that the scope of tasks and thus the corresponding strategic objectives of investor relations vary greatly depending on the size of the company.

In an online survey conducted by NIRI, 73% of the 384 IROs surveyed stated that they determine systematic goals within their IR agendas, which are usually revised and updated every year (cf. Brusch & Laskin & Ragas, 2014).. At the same time, the defined targets also justify corresponding evaluation criteria as the basis for the IR measurement.

Measurement criteria for investor relations

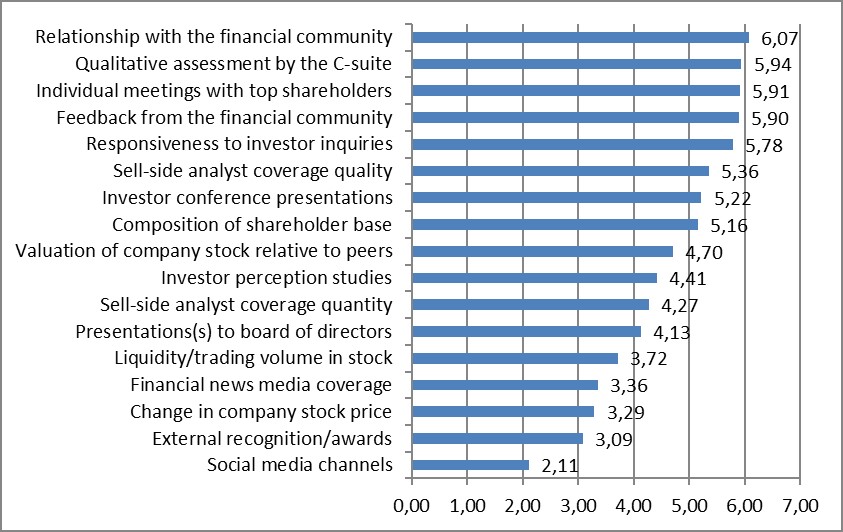

With their study Brusch & Laskin & Ragas 2014 identify a number of quantitative measurement criteria for the internal evaluation of the work of IR departments. Based on the discussion of common literature sources, they provide criteria for evaluation by the IROs of the NIRI network in their online survey. The table below shows the corresponding survey results:

Criteria for evaluating IR success

Source: Modified after Brusch & Laskin & Ragas (2014): Investor relations measurement: An industry survey, p. 184. Notes: Subjects were aked to „please rate the importance of each following criteria in evaluating the success of a company’s investor relations program[…]” where 1 ist “not important at all” and 7 is “extremely important”.

The study reveals that the most important criterion for measuring the success of their work for IROs is the „relationship with the financial community“, followed by the „qualitative (internal) evaluation by the C-Suite“ and „individual discussions with top shareholders“. The measures identified are thus borrowed from the key competence of the IROs already mentioned at the beginning, namely their communication function, which leads to the establishment of long-term relationship structures. Thus, the evaluation of these relationships is the decisive criterion in measuring the success of IR programmes. However, it is not only the establishment of relationships with players in the financial markets that is relevant, but also the maintenance of a good relationship with the company’s Board of Management. This fact once again emphasises the interface function that IR departments have within the corporate structure – both externally in the capital market and internally in the company.

In addition, IROs of the NIRI Association attach less importance to financial indicators and ratios that are based on market behaviour („trading volume on the stock exchange“, „changes in the share price“). External awards“ do not seem to be relevant for measuring their contribution to corporate success.

The study also reveals that IROs in large-cap companies attach greater importance to the evaluation of the relationship structures they have built up than their colleagues in

Small-Cap-Companies. This is due to the focus of the IROs‘ activities: IR departments in small-cap companies are often interested in attracting investors to their company, while IROs in large-cap companies instead maintain their already established network for stability.

At the same time, IR departments in large cap companies attach greater importance to internal feedback from the C-Suite to evaluate their own work. This may be due to a higher transfer of responsibility than is the case in smaller companies.

Sources:- BNY Mellon (2011), “Global trends in investor relations: seventh edition, a survey analysis of IR practices worldwide”, BNY Mellon, New York, NY.

- Brusch, M., Laskin, A. and Ragas, M. (2014): “Investor relations measurement: An industry survey”, Journal of Communication Management, Vol. 18 No. 2, pp. 176-192.

- Metzker, C. (2010), “Measure up”, IR update, June/July, pp. 10-13.