While a few years ago the investment community was reluctant to include digital media and social media in its approach, today it can hardly escape digitalization. This is the result of several surveys carried out in different parts of the European Union. Although there are several factors causing this shift in the IR ecosystem, the MiFID II directives have certainly contributed to triggering this effect.

Which digital communication channels do companies use?

Digital communication channels such as blogs, websites, social networks or video presentations are channels for the presentation of financial results, press releases, advertising, videos from telephone conferences, documents from investor days and thematic conferences and much more.

Investors expect more transparent information from digital sources – directly from executives – and that’s why on-demand video requests are growing rapidly in the current scenario and are expected to continue to grow in the future.

90% of investors use digital platforms & channels

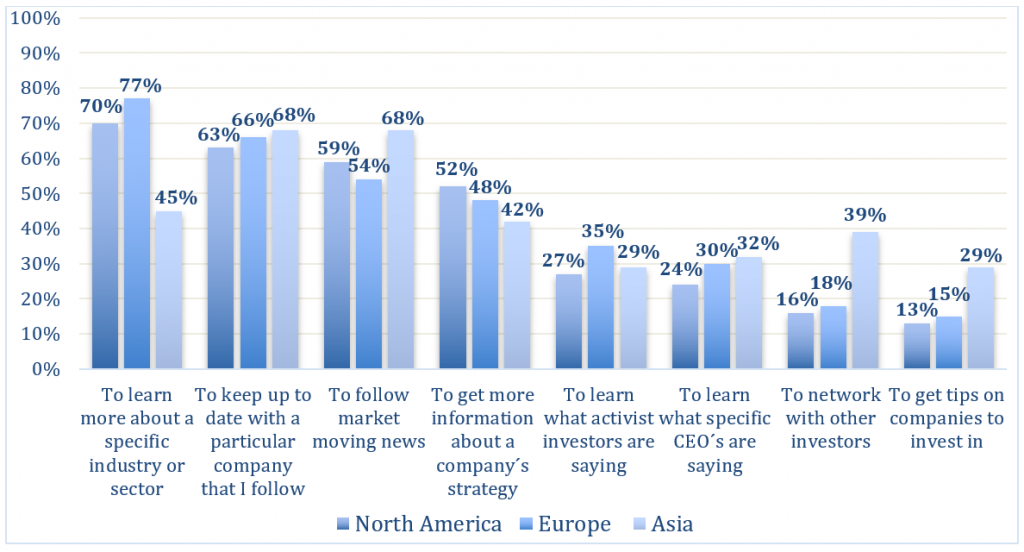

According to the latest Brunswick Investor Survey, 90% of all investors use digital platforms & channels. According to the latest Brunswick Survey, this shows that digital media should no longer be regarded as a “nice-to-have” in investor relations. Investors use digital media to inform themselves primarily about the market, but also about specific information about companies and their strategy, CEOs and their opinions, and the opinions of activist shareholders:

How Digital Media is Used. Question: What are the reasons you use digital media platforms to investigate an issue further for your work? Source: https://www.brunswickgroup.com/how-digital-is-driving-big-time-investment-decisions-i8091/

The results of this study shows: Investors who have learned how important it is to accept the change from the traditional to the digital environment use different digital communication channels. Whether it’s social media, corporate websites, press releases, research reports, survey results or virtual events such as webcasts, webinars, video conferencing and web conferencing, they’re trying to use every source to gather as much information as possible. In fact, a digital revolution is underway in the IR community as investor expectations continue to rise and digital media is the most convenient and fastest way to meet these expectations.

Investors use digital media to make investment decisions

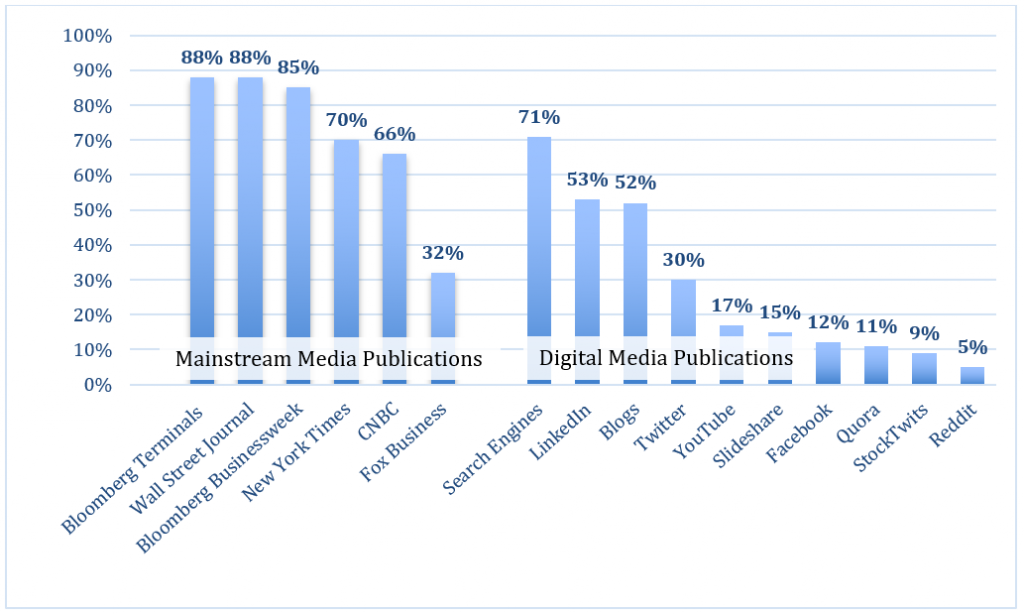

According to the Brunswick Investor survey on the use of digital media, these have significantly influenced the investment decisions of 88% of investors in the past. That’s not all. Surprisingly, around 98% of investors used digital media for problem analysis. What about the confidence that investors have in the various digital media?

Trust in Platforms vs. Trust in Media. Question: How much do you trust the following media sources to give you accurate and useful information for your work? Quelle: https://www.brunswickgroup.com/how-digital-is-driving-big-time-investment-decisions-i8091/

The Bloomberg terminals and the Wall Street Journal enjoy the highest confidence, followed by the Bloomberg Businessweek. Interestingly, search engines enjoy a slightly higher level of investor confidence at 71% than the New York Times at 70% and CNBC at 66%. And that in times of SEO and Goolge Adwords!

Among the classic social media channels, LinkedIn has a 53% share of investors, just ahead of the blogs with 52%. Twitter, on the other hand, is clearly outperformed with 30%, which is somewhat surprising due to the strong use of this channel by many listed companies.

Will the relevance of digital media increase?

Each study, market research and survey shows that digital media influences the investor niche and the financial industry in different ways. In addition, the inclusion of Big Data, Artificial Intelligence and Machine Learning significantly changes investor relations strategies and helps the investor community, especially IROs, to better understand what investors see, what kind of data they should exchange year-round, and to create and deliver more meaningful messages that are aligned with investors’ interests.

This suggests that no area is unaffected by digitisation, including the investment community. In fact, digital media have had an impact on how investors perceive, think and act.