Corporations of this century have seen a lot and undergone dramatic changes especially in corporate governance, activism and investor relations. A typical activist shareholder is the one who tries to use his or her equity stake in order to achieve certain goals, bring the change, and affect how a corporation behaves by influencing other shareholders or using his/her voting power. On the other hand, a minority shareholder is the one who owns less than 50% of the total shares of a corporation’s stocks.

How these activists try to influence the management varies from one corporation to another and depends on how these activists perceive concerned situations. While for some, they can appear to be an epitome of aggressive corporate raiders intervening companies’ policies and spotting the reputation, for others, they may prove to be playing a significant role in addressing structural management issues, resolving a company’s institutional issues and providing benefits to other passive shareholders.

In recent years, minority shareholders are consistently making efforts in raising their bar of expectations – a trend which we will continue to notice in 2019.

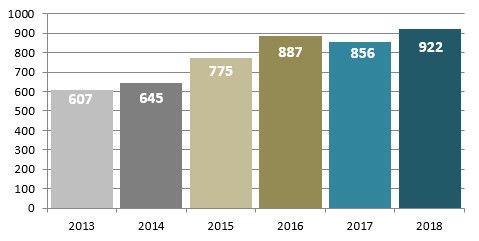

The past year (i.e. 2018) was cited as “Record Period” for activism as about 250 campaigns were initiated as compared to 210 campaigns in 2017. However, the growth of activism in the U.S. was considered to be moderate from 2017 to 2018 in terms of number of campaigns, capital investment, first-time activists, number of activists involved and board seats obtained, especially when campaigns against the announced merger and short-seller campaigns are not taken under consideration.

Along with this, in 2018, the uptick in activism in recent years has been slowed as it was observed that the global percentage of capital deployed in the campaigns of new activists in Europe was 24% which clearly indicates a decrease from 28% in 2016 and 35% in 2017.

Even though statistics reveal that activism will keep growing, we cannot rely on just statistical facts to grasp the real-time situation of activism and investor relations as they aren’t enough to see the bigger picture. If we traverse a few years back and come back to present, we can clearly notice the transformation that ubiquity of activists has brought on the typical mindset and course of actions of corporate boards, management, and institutional investors.

Although it is expected that activism will continue to evolve and remain the cynosure of the corporate realm in the light of new themes and changing market conditions, it is believed that the journey of activists will not be devoid of pitfalls.

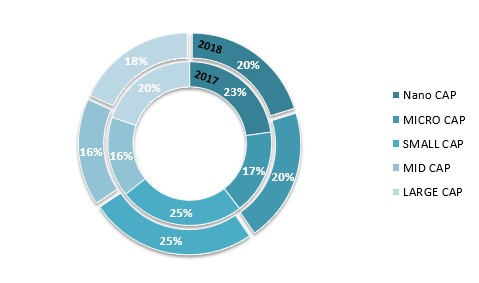

Now, the question is – which company size is most affected by minority shareholder activism? Generally, target companies of activists are the ones which fall in average size category but it is also noticed that sometimes, activists also target companies with large capitalization.

To be precise, companies with a market capitalization of $100-500 million are most frequently targeted by activists. In 2018, nearly 15% of the campaigns targeted companies with over $20 billion of capitalization, out of which 14 companies had a capitalization of more than $50 billion and only 2 companies had a capitalization of over $100 billion.

Unlike before, no firm, either big or small, can immunize itself from becoming the target of activist investors. For the record, large hedge funds managed by such as those Nelson Peltz, Carl Icahn, Daniel Loeb, and Bill Ackman have generated a lot of buzz in the media by confronting the boards of world-famous companies such as Apple, Rolls-Royce, PepsiCo, Nestle, and Danone.

But, the main challenge is how to defend your company against these activist shareholders? To smooth the ripples caused by these activists, many of the boards now prefer to regularly account the potential of an activist challenge related to oversight of companies’ operations, capital allocation, corporate transactions, management, and board composition. They have apprehend the fact that by adopting the approach of how these activists think will assist them in identifying possible weaknesses and vulnerabilities that can be a base for an activist challenge.