Micro and small-cap companies are the biggest players on the capital market. At least in terms of numbers. And: many fund managers believe they will perform better after the crisis. Nevertheless: The IR of micro and small caps must pay much more attention to the capital market than their mid and large cap competitors.

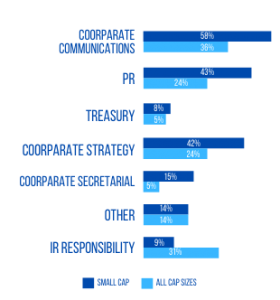

Therefore, the IR of micro and small caps also differs from that of larger companies. And – although micro and small cap companies have much less manpower and financial resources than larger companies, they still have to comply with the same regulatory obligations: Annual report, half year report, annual general meeting, analyst conference, ad hoc, directors dealings, voting rights, insider lists, … When all this has to be handled by one person who is also responsible for corporate communication and PR, there is no time for other issues. A study by IR magazine shows that in small-cap companies, IR officers are also responsible for corporate strategy, PR and corporate communication. Only every 3rd IR officer of a small-cap company is exclusively responsible for investor relations.

It is therefore no wonder that many small companies understand investor relations primarily as the fulfilment of regulatory obligations. There is hardly any time for investor relations, road shows and conferences. And it is no wonder that the CEO of small companies is often involved in IR.

How can micro- and small-cap companies nevertheless succeed in meeting more than just the regulatory obligations with limited effort?

Topic Financial Press

Getting into the financial press is difficult for small and micro caps. It is more realistic to be mentioned in a section of a bigger story. This is where those reporters have to be found who write on a larger topic. More realistic nowadays for small companies: writing smaller stories regularly or having them written and placing the equity story on the numerous financial press portals via specialised financial press distributors.

Topic Analyst Coverage

Since MiFID II, the issue of analyst coverage for micro and small caps has become even more difficult. Only a few brokers cover micro-cap companies with a market capitalisation of less than US$ 100 million. Small-cap companies could have a little more luck here. For many micro-cap companies, the only way out is through independent research providers. Small-cap companies could try to contact specialised sector brokers or brokers with a specialisation in small-cap and build up a targeted broker relationship.

Topic Investor Targeting / Organization of Roadshows

Getting institutional investors into the share register is particularly difficult for micro-caps and also poses a challenge for small-cap companies. Brokers, who still offer roadshows free of charge for various listed companies, rarely offer this free of charge for small-cap companies. Here, a separate targeting program can be set up. Corresponding data on investors and their focus can be obtained from financial information systems such as ThomsonReuters, Bloomberg, Ipreo etc. Many brokers now also offer paid roadshows. Other providers on the market for corporate access are independent research houses and investor relations agencies.

Specialised IR-Agencies

Some IR agencies have developed special programs for the needs of micro and small cap companies. These programs are aimed at institutional investors, analysts, retail investors, the financial press, family offices, etc., which focus on small and micro-cap companies. The services include: regular editorial articles on the corporate development of individual micro and small-cap companies, published on financial portals. Press reports, in which the company is involved, for financial journalists. The companies are presented to institutional investors, family offices, investment boutiques in virtual roadshows and conferences. Within the framework of micro and small cap coverage, the companies are outlined and presented to investors. The whole thing is rounded off by videos, podcasts and social media.

Of course, one or the other of these could also be carried out in-house. But as the above mentioned study of the IR magazine shows, most IROs are already busy with completely different topics.