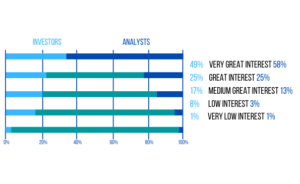

Investors (74%) and analysts (83%) showed great interest in the forecast report. According to the results, investors and analysts of SDAX companies in particular are very interested in this report. The following chart shows the interest of investors and analysts in the forecast report:

The forecast report is presented separately on one or two pages. The reason for the separate presentation is its very important role. 43 percent of those responsible for IR are in favour of presenting the forecast report separately and combining the opportunities and risk report. 16% present the three report components separately from each other. An integrated forecast, opportunity and risk report is presented by 33% of those surveyed.

59% present the forecast report separately from the report on opportunities and risks

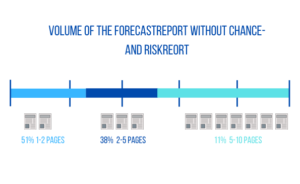

The forecast report (excluding the opportunities and risk report) is one to two pages long for the majority of IR officers. The forecast report is two to five pages for 38 percent. This applies in particular to DAX companies, which report more comprehensively due to their size. 11 percent report on five to ten pages.

Source: Click here. (Pages 18 & 19)